Kerala Faces 8,000–10,000 Crore Revenue Loss as New GST Rates Come Into Effect : K N Balagopal

Web desk

Published on Sep 11, 2025, 08:18 PM | 2 min read

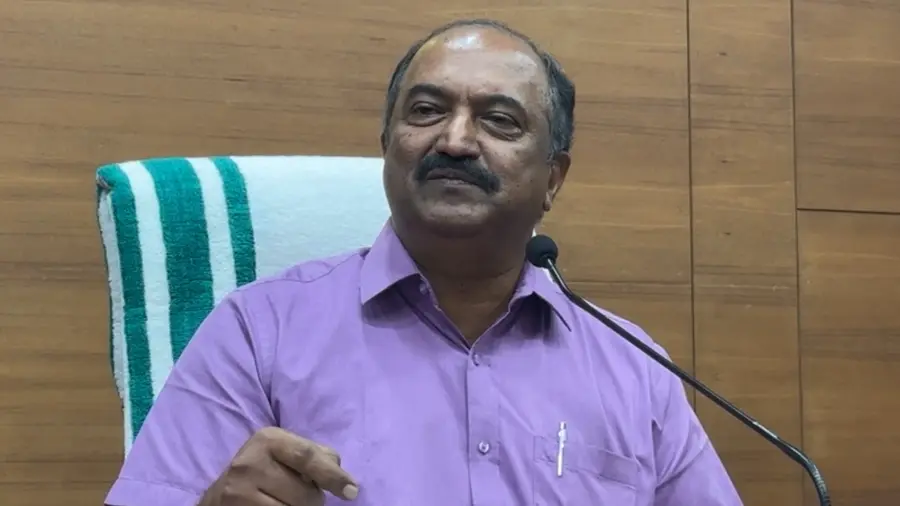

New Delhi: Kerala Finance Minister K N Balagopal on Thursday met the 16th Finance Commission in New Delhi and apprised them of the state’s expected revenue loss due to the Goods and Services Tax (GST) rate rationalisation.

Last week, the GST Council approved a two -rate structure, 5 and 18 per cent, which will reduce the prices of a large number of items. The revised rates will come into effect from September 22. While Kerala supports the rationalisation, the state has raised concerns over an anticipated annual revenue loss of 8,000 to 10,000 crore rupees and has sought compensation.

Briefing the media, Balagopal said he met Finance Commission Chairman Arvind Panagariya and other members, submitting a supplementary memorandum detailing the state’s revenue concerns. He highlighted that Kerala’s estimated annual revenue loss due to GST cuts would be 8,000 to 10,000 crore rupees, including around 6,300 crore rupees from Goods tax revenue.

Balagopal also clarified that there will be no increase in the price of lotteries in Kerala despite the GST rate on lotteries rising from 28 per cent to 40 per cent under the new regulation. A proposal to raise the ticket price from 50 rupees was considered but rejected. Instead, the prize money will be slightly reduced from previous levels, affecting around 2 lakh people involved in the lottery sector.

He further pointed out the negative impact of high US tariffs on Kerala’s exports, particularly marine products and spices, estimating a revenue loss of approximately 2,500 crore rupees. He expressed hope that the Finance Commission would give due consideration to the state’s submissions.

Kerala’s share from the divisible pool has declined over time, from 3.87 per cent during the 10th Finance Commission period to 1.92 per cent during the 15th Finance Commission, an issue the state has consistently raised. “Development should not be a negative thing… we need to get justice,” Balagopal said.

The 16th Finance Commission, comprising Annie George Mathew, Manoj Panda, T Rabi Sankar, and Soumya Kanti Ghosh, is expected to submit its report to the Centre by October 31. The Commission’s key role is to recommend the distribution of net tax proceeds between the Union government and the states, including each state’s share.

0 comments