Kerala Debunks “Debt Trap” Narrative

Web desk

Published on May 21, 2025, 05:32 PM | 5 min read

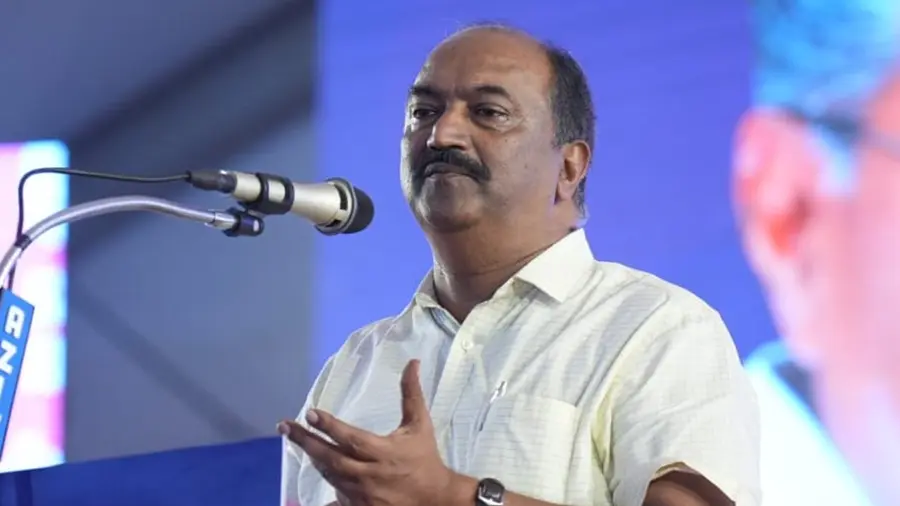

Thiruvananthapuram: Right-wing media outlets have recently been amplifying a misleading narrative that Kerala is trapped in unsustainable debt. On Wednesday, Kerala’s Finance Minister K N Balagopal countered this claim, stating that such assertions are entirely disconnected from reality. In fact, the state’s debt burden has been steadily decreasing over the past year. The Finance Minister’s office clarified that Kerala’s borrowings remain well within limits proportional to the size of its economy.

All Indian states must follow strict criteria to borrow funds. These include approvals from the state legislature, the Parliament, the Reserve Bank of India, and the Central Government. According to current guidelines, Kerala is permitted to borrow up to 3.5% of its Gross State Domestic Product (GSDP). In 2022–23, the state borrowed 2.5% of its GSDP, and in 2023–24, it rose slightly to 2.99%—still within the approved limit. However, Kerala has repeatedly faced restrictions on accessing its full borrowing entitlement from the Centre, despite adhering to all stipulated norms.

The key metric for evaluating fiscal stability is the debt -to- GSDP ratio. According to data from the State Economic Statistics Department, Kerala’s debt -to -GSDP ratio has been declining consistently since 2020–21. That year, the ratio stood at 38.47%. It dropped to 35.38% in 2022–23, 34.2% in 2023–24, and further to 33.9% in 2024–25.

In 2020–21, Kerala’s GSDP was 7.79 lakh crore rupees, and its debt stood at 2.96 lakh crore rupees. By 2023–24, the GSDP had risen to 11.46 lakh crore rupees, while debt increased to 3.91 lakh crore rupees. In 2024–25, the GSDP further climbed to 12.75 lakh crore rupees, and the debt reached 4.31 lakh crore rupees. These figures clearly show that while total debt has grown, it has done so at a pace slower than the growth of the state’s economy, resulting in a declining debt -to -GSDP ratio. Therefore, the opposition’s claim that the state is struggling under the weight of loans is demonstrably false.

Historical data reveals that Kerala's debt indicators were at their worst during the UDF government’s rule. Between 2001 and 2006, the GSDP grew by 13.1%, while debt rose by 14.3%.

During the LDF government’s tenure from 2006 to 2011, GSDP growth was 13.7%, but debt growth was curbed to 11.4%. Under the UDF again (2011–2016), when GSDP growth dropped to 11.6%, the debt growth rate spiked to 14.9%. From 2016 to 2021—marked by severe floods and the COVID-19 pandemic—GSDP growth fell to 6.8%, and debt growth remained high at 13.5%, largely due to falling revenues and emergency spending needs.

In contrast, under the second Pinarayi Vijayan -led LDF government (2021–2025), Kerala saw an average GSDP growth rate of 13.5%, while the average debt growth rate fell to just 9.8%, indicating a more sustainable fiscal trajectory.

Over the past three decades, Kerala’s total debt liability has approximately doubled every five years. In 2010–11, total liabilities stood at 78,673 crore rupees. This rose to 1.57 lakh crore rupees in 2015–16 and 2.96 lakh crore rupees in 2020–21. Following the same trend, the debt should have reached 6 lakh crore rupees by 2025–26. However, current figures show it at 4.65 lakh crore rupees —a significantly lower amount. This is not due to better support from the Centre but largely because Kerala was denied permission to borrow its entitled amounts. Had these funds been approved, the state could have implemented more developmental and welfare projects.

This year, the Centre has further slashed Kerala’s borrowing capacity. An additional 3,300 crore rupees was cut from the state's borrowing limit, citing a requirement for a Guarantee Redemption Fund. Kerala has extended guarantees worth 80,000 crore rupees for loans and investments in public sector undertakings. The Centre now demands that 5% of this amount be set aside in a Guarantee Redemption Fund, failing which 0.25% of the GSDP—equivalent to 3,300 crore rupees—will be deducted from the borrowing limit. This stipulation was conveyed in a recent letter from the Union Government, following an earlier intimation that Kerala would be allowed to borrow 29,529 crore rupees until December 2025.

Such restrictive conditions have been repeatedly imposed on Kerala over the years. In earlier instances, the Centre cited balances in the Public Account, borrowings by KIIFB (Kerala Infrastructure Investment Fund Board), and loans taken by the Welfare Pension Company to curtail Kerala’s borrowing rights. Even these past borrowings by KIIFB have been retroactively used to limit fresh loans over the last two years. The pattern continues with new obstacles being introduced every year to restrict Kerala’s access to essential funds.

Adding to the fiscal pressure, the Centre has deducted 956.16 crore rupees from Kerala’s share of the Integrated GST (IGST), citing past over-disbursements. However, there is still no transparent framework in the GST system to verify such settlements.

Centre’s Own Debt Position

It is also important to examine the fiscal responsibility of the Centre itself. The Union Government’s debt- to- GDP ratio stands at a staggering 58.1%, with total liabilities reaching ₹155 lakh crore. The fiscal deficit was 5.6% in 2023–24 and is projected at 4.4% for the current year, though final figures are expected to be higher than the official claims. Despite this, efforts continue to single out Kerala, obscuring the Centre’s own mounting debt while painting a distorted picture of the state's finances.

In summary, Kerala’s financial management is firmly grounded in legal and fiscal prudence. The state’s debt is proportionate to its economic output and is on a declining trajectory—contrary to the misinformation being spread. The real issue lies not in the state’s borrowing but in the unjustified constraints imposed by the Centre.

0 comments