Kerala

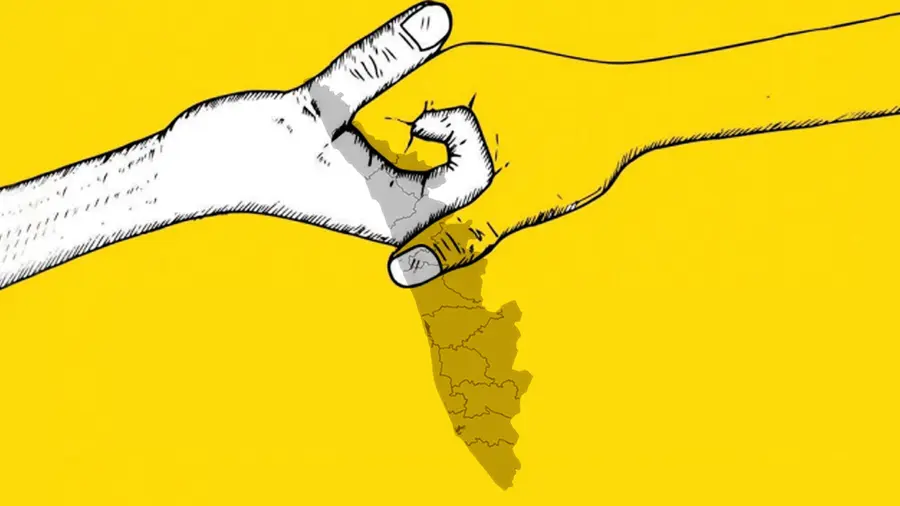

Kerala Government Steps In to Protect Extreme-Poor Families from Property Seizure

Anusha Paul

Published on Jul 14, 2025, 01:06 PM | 2 min read

Thiruvananthapuram: The Government of Kerala is taking decisive steps to support extreme-poor families facing the threat of property seizure due to unpaid loans. As part of its broader initiative to eliminate extreme-poverty from the state by November 1, the Local Self Government Department has initiated a comprehensive process to identify and assist families who have defaulted on loans from various financial institutions.

A list of 12,326 extreme-poor families with existing loan liabilities has been compiled, and a detailed verification is underway to determine the extent of financial distress. As part of this, a pilot survey was conducted among 300 randomly selected households. The survey revealed that 102 families had active loan obligations, while only six (5.9%) were at immediate risk of property seizure due to non-repayment.

Related News

This initiative is a key component of the state government’s micro-planning strategy aimed at ensuring that no family remains trapped in extreme poverty. The verification process is being carried out at the grassroots level using a structured questionnaire developed and administered by District Planning Officers.

The survey sample included 123 men and 177 women, with no representation from the transgender community. Of the total households surveyed, 214 were located in grama panchayat areas. The survey also included 66 participants from the Scheduled Caste (SC) community and 20 from the Scheduled Tribe (ST) community, ensuring representation of socially and economically disadvantaged groups.

The survey found that the primary reasons for taking loans included house construction and renovation, medical treatment, marriage expenses, and education. A majority of borrowers had taken loans from cooperative banks, with 33 families indicating this as their source. Another 26 families had borrowed from microfinance organisations such as Kudumbashree, 13 from commercial banks, and 12 from private moneylenders.

Among the 102 families with outstanding loans, 26 had borrowed for housing-related needs, while 24 required funds for hospital expenses. Seven families reported taking loans for marriage, and four for their children's education. Of these, 20 families had not repaid any portion of their loans at the time of the survey, whereas eight had repaid the entire amount.

Through this initiative, the Kerala government aims to provide structured financial relief to extreme-poor households under threat of losing their homes or assets. The move is a crucial step in reinforcing economic stability and achieving the goal of a poverty-free Kerala.

0 comments